Assignment Overview

RobertDouglas advised CS&M Associates, a joint venture between Marriott and MetLife Investment Management, on the refinancing of its existing loan for the iconic Sheraton New Orleans. The short-term, floating-rate financing was provided by an international bank balance sheet lender at a highly attractive pricing.

Property Background

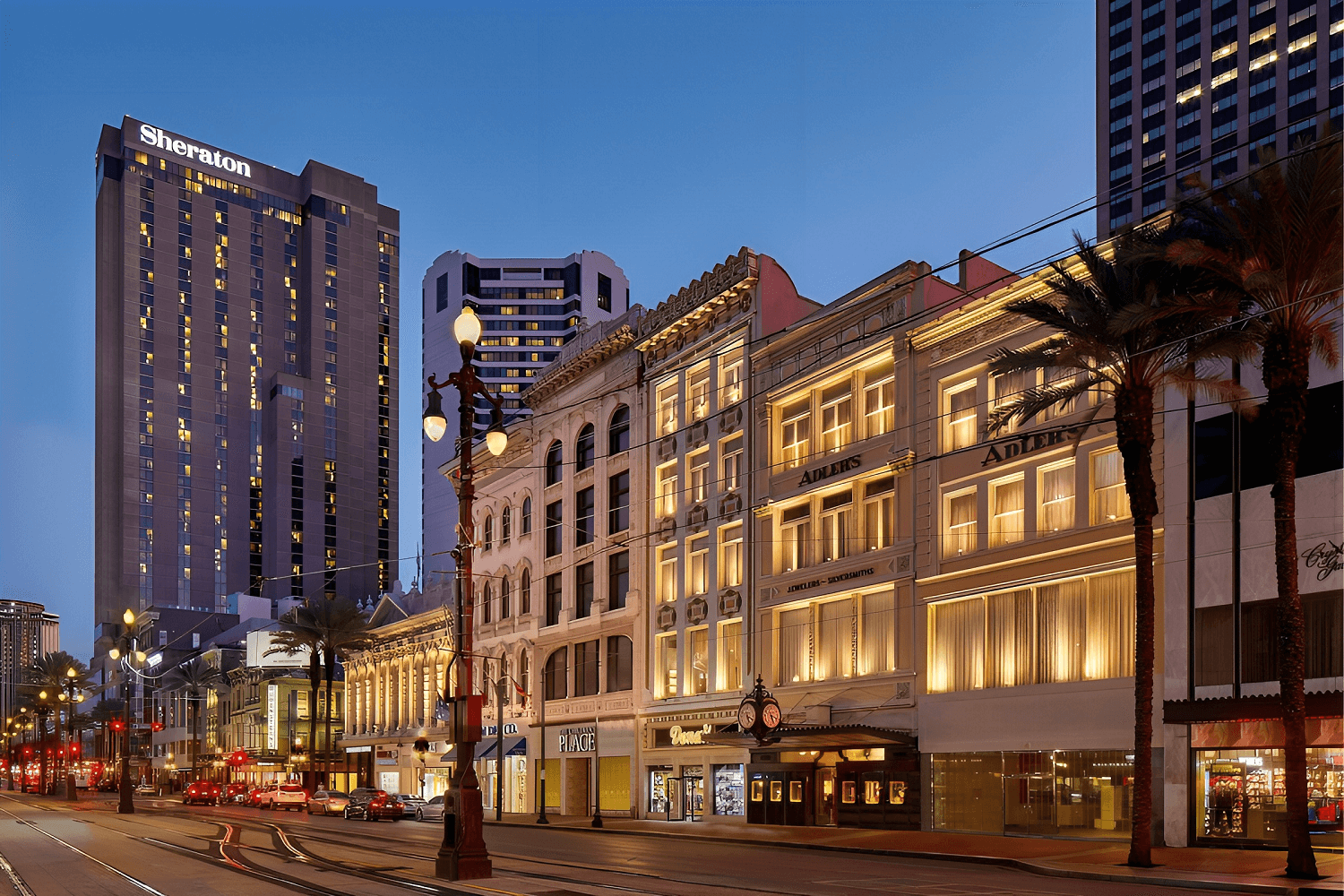

The flagship, 1,110-key Property occupies an irreplaceable location in one of the nation’s premier lodging markets and features 106,000 square feet of sophisticated meeting facilities. With a superb location on Canal Street and in the epicenter of convention, leisure, and corporate demand generators, the Hotel is walking distance to the famed French Quarter, Caesars Superdome, Smoothie King Center, 1.1 million-square-foot Ernest N. Morial Convention Center, and Central Business District (CBD). New Orleans welcomes over 20 million annual visitors, brought to the city for a multitude of reasons including its vibrant cultural scene, world-renowned festivals such as Mardi Gras, 4th largest port in the United States, 6th largest convention center in North America, prominent universities, medical centers, and 5 professional sports team.

Deal Highlights

| Client: Lender: Debt Proceeds: Key Count: | CS&M Associates Balance Sheet Lender $100.0 million 1,110 |