Assignment Overview

RobertDouglas advised Cornerstone Real Estate Advisers, on behalf of Massachusetts Mutual Life Insurance Company, on the $37.5 million financing of the Hilton Sedona Resort & Spa. The long-term, fixed-rate financing was provided by a global health insurance company. The financing opportunity drew substantial interest from many debt providers as a result of the Resort's excellent sponsorship, high-quality and improving collateral, and strong in-place cash flow.

Project Overview

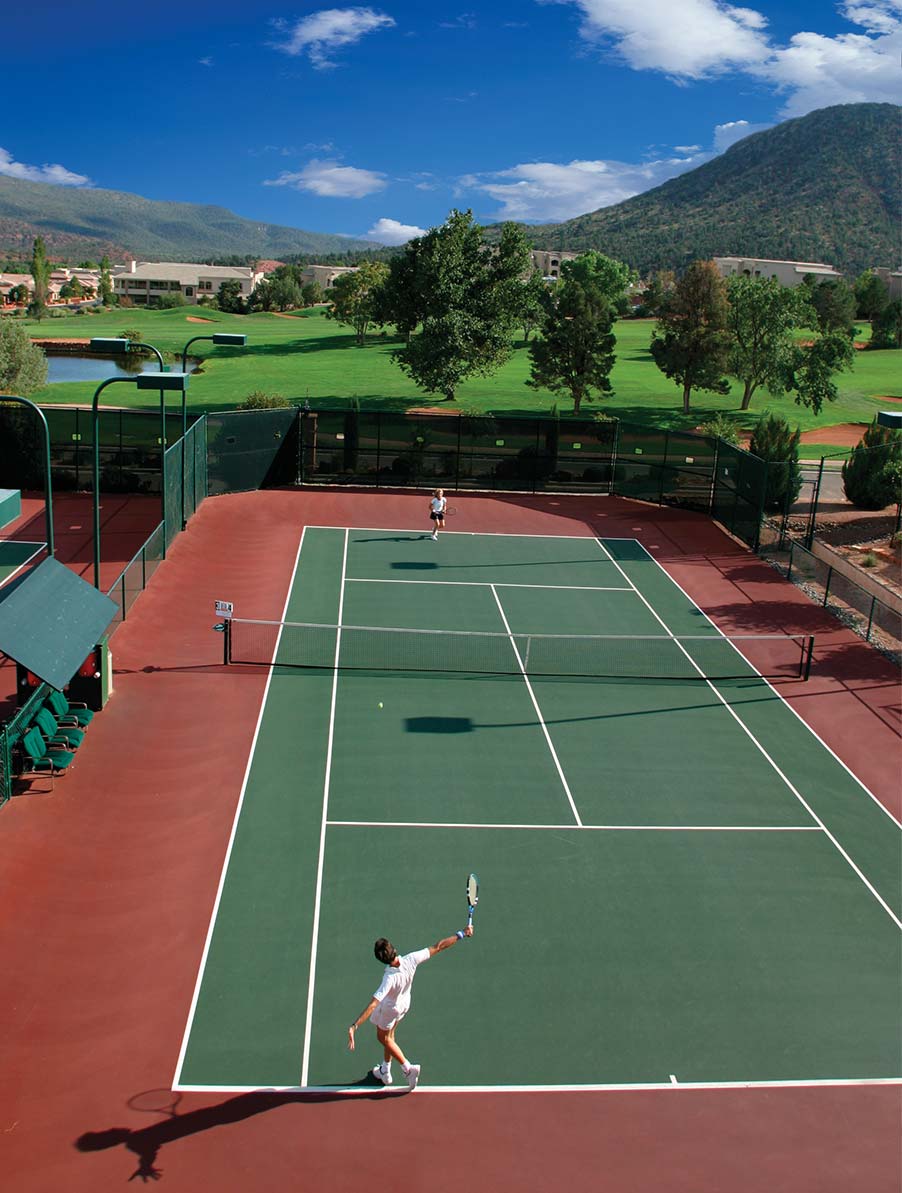

As Sedona’s only full-service, nationally-branded resort, the Hilton Sedona enjoys a distinct competitive advantage and has established itself among the market’s leading properties. The Resort – which features 219 oversized guestrooms, two food and beverage outlets, 23,500 square feet of meeting space, a full-service spa and fitness center and myriad recreational amenities – is currently undergoing a substantial renovation of its guestrooms and lobby that will continue to improve the hotel’s performance.

Deal Highlights

| Client (Borrower): Lender: Financing Proceeds: Key Count: | Massachusetts Mutual Life Insurance Company Global health insurance company $37,500,000 219 |